Download the database (.xls) – Download the entire Chartbook (.pdf)

Sources and References

Sources:

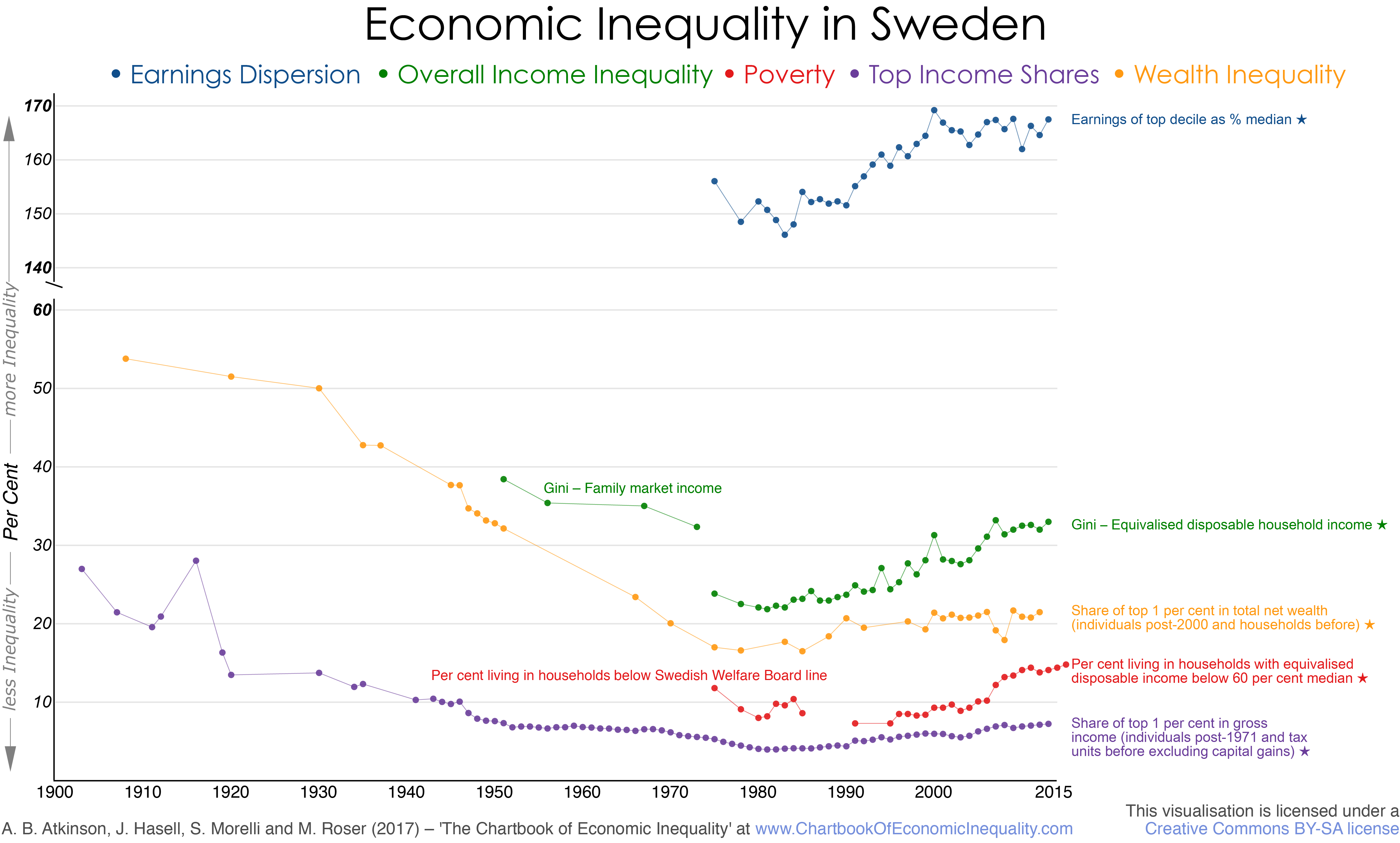

Overall inequality: Series 1: Gini coefficient of equivalised disposable income from 1975 from the website of Statistics Sweden, Income Distribution 1975-2013, linked backwards at 1988 using ratio of 1989-rev to 1989 values; series 2: earlier series from 1951 to 1973 for family market income from Björklund and Palme (2000, Table 2) linking tax register data for 1951 and 1956 to data from the Swedish Level of Living Survey for 1967 and 1973.

Top income shares: Share of top 1 per cent in total gross income from WID.world (tax units, excluding capital gains), based on work of Roine and Waldenström (2010). Note that the concept of tax unit changed from married couples (filing a joint tax return) to individuals (whether married or not filing tax returns separately) in 1971 (although there was an option to file separate returns from 1966).

Poverty measures: Percentage of individuals living in households with equivalised disposable income less than 60 per cent of the median from Statistics Sweden website, Household Finances; earlier figures for percentage of individuals living in households below Swedish Welfare Board line, Table 2.

Dispersion of earnings: Earnings at top decile as percentage of median earnings, based on series given in Atkinson (2008, Appendix Q, Table Q.5); from 2005 onwards, taken from OECD iLibrary, Employment and Labour Market Statistics, Gross earnings decile ratios (accessed 22 February 2017).

Wealth inequality: Share of top 1 per cent of households in total net marketable wealth at market values based on wealth tax assessments from Roine and Waldenström (2015), downloaded from Waldenström’s webpage, drawing from Roine and Waldenström (2009, Table A1), joined at 2000 to estimates of top 1 per cent of individuals in total capitalized wealth based on income and property tax registers from Lundberg and Waldenström (2016, Table A1).

References:

- Atkinson, A B, 2008, The changing distribution of earnings in OECD countries, Oxford University Press, Oxford.

- Björklund, A and Palme, M, 2000, “The evolution of income inequality during the rise of the Swedish welfare state 1951 to 1973”, Nordic Journal of Political Economy, vol 26: 115-128.

- Lundberg, J and Waldenström, D, 2016, “Wealth inequality in Sweden: What can we learn from capitalized income tax data?”, Uppsala University discussion paper.

- Roine, J and Waldenström, D, 2009, “Wealth concentration over the path of development: Sweden, 1873-2006”, Scandinavian Journal of Economics, vol 111: 151-187.

- Roine, J and Waldenström, D, 2010, “Top incomes in Sweden over the twentieth century” in A B Atkinson and T Piketty, editors, Top incomes: A global perspective, Oxford University Press, Oxford.

- Roine, J and and Waldenström, D, 2015, “Long run trends in the distribution of income and wealth” in A B Atkinson and F Bourguignon, editors, Handbook of Income Distribution, volume 2, Elsevier, Amsterdam.